![]() Contact Us (866) 499-8989

Contact Us (866) 499-8989

Are Personal Injury Settlements Taxable in Arizona?

- Why Personal Injury Lawsuits Are Generally Not Taxed

- Which Damages Aren't Taxable in a Personal Injury Settlement?

- Which Personal Injury Damages Are Taxable in Arizona?

- Is Lost Income Awarded in a Personal Injury Settlement Taxable?

- Is Pain and Suffering Taxable?

- Tips for Reviewing Documents to Assess Your Tax Responsibility

- How a Personal Injury Lawyer Can Help With Tax Implications of a Settlement

- Call Us Today for Legal Help With a Personal Injury Lawsuit

- Home

- FAQs

- Personal Injury

- Are Personal Injury Settlements Taxable in Arizona?

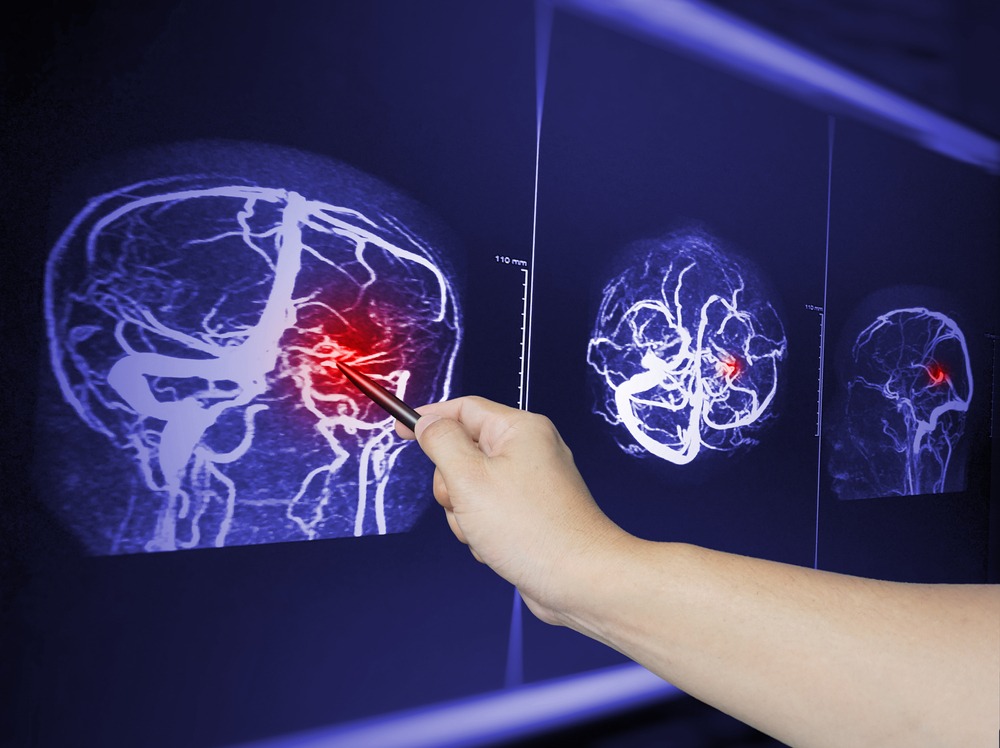

Personal injury settlements are usually not taxable in Arizona under federal or state law. If you receive money from a settlement for a physical injury or sickness, this money typically is not taxed. This includes most injury cases, such as those involving car accidents or slip and fall injuries.

In these settlements, the portion of the money covering medical costs and pain from the physical injury is not taxed. However, if the settlement includes money for other damages, like punitive damages or interest, plaintiffs may have to pay taxes for those parts.

No two settlement awards are exactly alike, so it’s important to look at the details carefully. If you are seeking legal help after suffering injuries or losses because of someone else’s negligence, our Phoenix personal injury lawyer can help you.

Why Personal Injury Lawsuits Are Generally Not Taxed

In Arizona, the money you recover from a personal injury lawsuit is usually not taxed because it is meant to help you cover costs from your injury, not give you extra income.

Tax authorities see this money as a way to restore your financial situation to what it was before you got hurt. Arizona and the federal government generally agree on this rule regarding taxes and personal injury settlements.

For a free legal consultation, call (866) 499-8989

Which Damages Aren’t Taxable in a Personal Injury Settlement?

If you received a personal injury settlement, you generally will not be taxed on the following damages:

- Compensation for physical injuries or illness: This includes medical expenses (e.g., hospital treatment, doctor’s visits, prescription medications, assistive medical devices, etc.), pain and suffering, and all physical rehabilitation-related costs. You could, however, be required to pay taxes if you took a tax deduction for medical expenses related to your accident but later received a reimbursement for those same expenses.

- Compensation for emotional distress related to the physical injury: If the emotional distress is directly linked to the physical injury, it’s not taxable.

These non-taxable items are based on federal tax laws. The idea is that these payments are compensatory, returning the individual to their pre-injury financial status and not providing income.

Which Personal Injury Damages Are Taxable in Arizona?

In a personal injury lawsuit in Arizona, certain elements of the settlement may be taxable, such as:

- Punitive damages: A court may award these damages to a plaintiff to punish the defendant for extremely harmful behavior. The payment is seen as extra income for the plaintiff, so it is taxable, per the Internal Revenue Service (IRS). However, punitive damages are not taxable in wrongful death cases if the state law specifically only allows punitive damages for such cases. This exception is outlined under Internal Revenue Code (IC) § 104(c).

- Interest on the settlement: If your settlement accrues interest from the time of the award until you receive payment, this interest is taxable.

- Portion for emotional distress damages not stemming from physical injury: Compensation solely for emotional distress that does not originate from a physical injury is subject to taxes.

Click to contact our personal injury lawyers today

Is Lost Income Awarded in a Personal Injury Settlement Taxable?

Yes. If you recover compensation for lost income from a personal injury settlement, you must claim it as income; therefore, it is taxable. The payment you received replaces the wages or salary you would have earned if you hadn’t been injured, and such income would normally be subject to taxes.

Essentially, the IRS treats this part of the settlement as if it were your regular income.

Complete a Free Case Evaluation form now

Is Pain and Suffering Taxable?

Generally, non-economic damages, such as pain and suffering, are not taxable. However, if you receive damages for pain and suffering that are not linked to a physical injury or medical expenses for pain and suffering, you could be required to pay taxes.

For example, in a discrimination or wrongful termination lawsuit, any awarded pain and suffering damages would likely be taxed because they are not linked to a physical injury.

Always review your case’s specific circumstances if you are wondering if personal injury settlements are taxable. You can also consult with a tax professional to understand your tax obligations.

Tips for Reviewing Documents to Assess Your Tax Responsibility

When reviewing court documents related to your personal injury settlement, it’s important to understand how your financial recovery might affect your taxes. Here are some tips to help:

- Identify various types of damages: Review how your settlement is broken down. Differentiate between compensatory damages for physical injuries (usually non-taxable) and punitive damages or lost wages (taxable). An attorney can help with this task.

- Check for specific language: Pay attention to the language used to describe the compensation. Terms like “emotional distress” and “physical injuries” can indicate tax implications.

- Keep detailed documents: Keep records of all paperwork and correspondence related to your settlement. These records can be invaluable for tax preparation and any future queries from the IRS.

- Consult a tax professional: Since legal documents can be complex and the tax laws change, it’s wise to meet with a tax professional. They can provide advice based on the latest laws and your specific circumstances.

To get an idea of what to discuss with an attorney, you can also review five tax tips to follow after receiving a personal injury settlement.

How a Personal Injury Lawyer Can Help With Tax Implications of a Settlement

When you understand your court documents, you can better prepare for any tax responsibilities that come with your settlement. We can help distinguish between taxable and non-taxable components of the settlement, such as differentiating between compensation for physical injuries (non-taxable) and punitive damages (taxable).

We can also make sure you have the proper documentation of the settlement terms, which you will need for tax purposes.

For advice tailored to your situation, consult a licensed tax professional. The information on this page is for general informational purposes only and should not be considered legal or tax advice. This page does not replace the need for professional consultation with a tax expert.

Call Us Today for Legal Help With a Personal Injury Lawsuit

Are personal injury settlements taxable in Arizona? Generally, personal injury settlements are not taxable if they compensate victims for physical injuries or sickness. However, parts of the settlement can be taxed if they are not linked to a physical injury, such as punitive damages.

Having an attorney can help plaintiffs navigate a complex settlement or recover one for injuries or losses. If you or a loved one is recovering from injuries suffered in an accident, such as a car accident, slip and fall, or wrongful death, Zanes Law can lead your case and work to recover damages for you. Call or contact us online today for a free consultation.

Call or text (866) 499-8989 or complete a

Free Case Evaluation form

Injury Lawyer Doug Zanes Interviewed For “Business Leader Spotlight”

Injury Lawyer Doug Zanes Interviewed For “Business Leader Spotlight”

Doug was recently interviewed by Randy Van Ittersum on the "Business Leader Spotlight Show." It was a great experience and gave him the opportunity to share important topics that are super

Need Personal Injury Legal Advice? Listen to Our NEW Podcast by Doug Zanes!

Need Personal Injury Legal Advice? Listen to Our NEW Podcast by Doug Zanes!

We are excited to announce that we have officially launched the Zanes Law Personal Injury Legal Tips podcast, featuring advice from Zanes Law owner and responsible attorney Doug Zanes. When

Should you hire an injury attorney? 5 Things You Need to Know

Should you hire an injury attorney? 5 Things You Need to Know

We know that when you’ve been injured in an accident, it can be difficult to take legal action quickly. After an accident, you might just want everything to be over and done with, so you

Can I Settle An Injury Claim On My Own?

Can I Settle An Injury Claim On My Own?

Nobody expects to be in an accident—let alone get injured in an accident—but when it does happen, you may be asking yourself a lot of questions, including, “Can I settle an injury claim on my

Receive a Free, No-Obligation, Case Evaluation Now